The potential expiration of the Mortgage

Fairness Debt Relief Act on Dec. 31 may not be as ominous for some

Arizonan homeowners as it is for much of the rest of the country. That being said, it may not go entirely unnoticed by local homeowners looking to unload through a short sale. On the bright side, Arizona, along with 11 other states, is a nonrecourse state. That

means when it comes to most mortgages, if there’s a foreclosure or

short sale, the lender gets the property back and that’s the end of the

matter. The homeowner has no personal liability for the debt owed on the

home, provided it was used to purchase the house.

So state law,

when combined with Section 108 of the Internal Revenue Code, the

little-known tax law the federal debt relief act actually expanded on,

allows most Arizonans to unload underwater homes through a short sale

without facing hefty tax penalties. In recourse states, homeowners

facing a short sale aren’t as fortunate. For tax purposes, the

canceled, or forgiven, debt is considered income and is taxable.

That’s

why Congress passed the Mortgage Fairness Debt Relief Act in December

2007. The legislation allowed homeowners going through a short sale or

foreclosure — whether or not they lived in a nonrecourse state — not to

get taxed on the debt they were forgiven. “It was really popular

when it came out because the tax was hurting people who could least

afford it, the people who had lost a huge amount of home equity, and it

just seemed to be putting salt in the wound to then tax them on the debt

cancellation,” said Michael Orr, director of the Center for Real Estate

Theory and Practice at the W.P. Carey School of Business at Arizona

State University. For underwater homeowners in recourse states, the legislation offered a welcome reprieve in a dismal situation. “When you look at it at a national level, there’s even more reason to put this in place,” Orr said. However, that doesn’t mean the potential expiration of the federal legislation won’t affect the Arizona housing market.

The Maricopa short-sale market

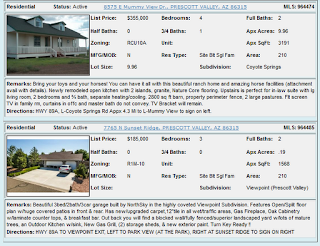

Despite a gradual recovery in the housing market, short sales aren’t slowing down. “We certainly haven’t been through all the short sales we’re going to see,” Orr said. According

to the W.P. Carey business school’s June housing report for the greater

Phoenix area, although foreclosures are down, short sales have

increased 8 percent since June a year ago. Short sales and

pre-foreclosures also made up 20 percent of the total number of

single-family home sales during the same 12 months. In Maricopa, 50 of the 267 single-family home sales in June were short sales, with a median sale price of $94,500. But with the expiration of the federal law, all that could change. Orr

said that if the debt relief act isn’t renewed, it could “have a

chilling effect on short sales in 2013 … because more people are going

to think it’s not worth going through the short sale,” Orr said. Since

housing prices are going up, the number of people underwater is

decreasing, which in turn reduces the amount of debt they would be

forgiven — and taxed on. That, in turn, could convince people to hold on to their home and exacerbate an ongoing housing shortage. It’s a concern shared by Teri Parks, a local real estate agent with Desert Canyon Properties. “It’s going to make our job harder,” Parks said. “It’s going to be real hard to get listings next year, and we need listings.”

Who’s covered by Section 108?

Technically, Section 108 says forgiven debt — often referred to as “phantom income” — will be taxed.

“It’s

just possible, in reality, that the debt relief act is not as powerful

as Section 108 in the Internal Revenue Code always has been,” said

Eckley, a real estate attorney and managing attorney at Eckley &

Associates in Phoenix. Section 108 applies to any debt attached to

a property that is “two and a half acres or less, the money was used to

purchase the property, and the property is capable of residential

occupancy,” Eckley said. However, there are three broad exceptions

under which that tax will be forgiven, and the majority of homeowners

in Arizona generally fall under one, if not all, of them. The first exception has to do with state law that makes Arizona one of only 11 nondeficiency states. “Since

they never had the debt, not paying it back is not an event that

triggers Section 108 because there was no debt that was a lawful,

personal obligation,” Eckley said. The second exception allowing a

homeowner to escape the debt tax pertains to anyone insolvent on a

balance-sheet basis at the time of the short sale. The third exception covers anyone who is bankrupt or going through a bankruptcy. Section

108, however, is still broader in scope, also covering those who may be

trying to short sell an investment property because the loan doesn’t

have to be attached to a primary residence. It just has to be something a

person can reasonably live in. “And believe me, that applies to

an awful lot of houses here, too,” Eckley said. “We have an awful lot of

absentee owners; we have a lot of stuff here the (debt act) never

touched.”

Who’s not covered by Section 108?

Yet even with Section 108 in place, some Maricopans could still slip through the cracks. For example, a person may need to get rid of a home but may not be insolvent or bankrupt. “A

lot of people are unloading not just because they’re out of money;

they’re unloading because they’re tired of putting money down a rat

hole,” Eckley said. Even going through a bankruptcy doesn’t

guarantee exemption from taxation, however. It all depends on how the

debt attached to the property is used. “Those that had, say, a

second (mortgage) taken out for purposes of buying something other than

the house,” Eckley said, would not be covered by Section 108 because

debt not used to purchase the property is recourse debt. “Like,

they take out a (home equity loan) and they bought some his and hers

Hummers or something or they bought stock,” Eckley said.

And that’s when the debt relief act matters to Arizonans. “The

mortgage debt relief act said, ‘I don’t care if it’s recourse or

nonrecourse; we’re not going to make you pay on it.’ That’s big,” Eckley

said. “It will also cover obligations secured by the property that were

not used to purchase it; that’s a big change.” So those who were

hoping to be covered by the debt relief act may be in for an unpleasant

surprise tax bill, depending on what the borrowed money attached to the

property, was used for. “The number of people who understand that they might have to pay tax on forgiven debt is probably very low,” Orr said. Parks

pointed out: “It’s going to (anger) a lot of people next year when they

find out that they’re going to have to pay taxes on (canceled debt).”

Tax-free doesn’t mean clean credit

Ultimately,

even if a person escapes being taxed on canceled or forgiven debt,

there’s no escaping the fact that a short sale could negatively impact

their credit rating. But even that depends on how the homeowner stands with lender going into the short sale. “If

you do a short sale, but you were actually current on your mortgage,

some lenders will allow you to take out a new loan on a new house

immediately, so you don’t even have to be locked out of the market as

long as you were never late on your mortgage payment,” Orr said. “Now

a short sale in which you didn’t pay on time for, say, six months, were

behind on your credit, that will almost certainly be a ding on your

credit,” he said.